kentucky sales tax on vehicles

Kentucky does not charge any additional local or use tax. Are services subject to sales tax in Kentucky.

Used Cars Trucks Suvs For Sale In Hazard Ky Tim Short Chrysler Llc

Motor Vehicle Usage Tax Sales Tax Use Tax May 1 2014.

. 16 2022 To help Kentuckians combat rising prices due to inflation brought on by the global pandemic Gov. Vehicle rental excise tax. KRS 138472 establishes a new 6 excise tax on the gross receipts of vehicle rentals peer to peer car sharing rentals transportation network company services taxicab services and limousine.

Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. Andy Beshear announced today that he is.

The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky. Sales and Use Tax Laws.

Arizona California Florida Indiana Massachusetts. While Kentuckys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The tax would be levied at the rate of 6 of the gross receipts derived from the.

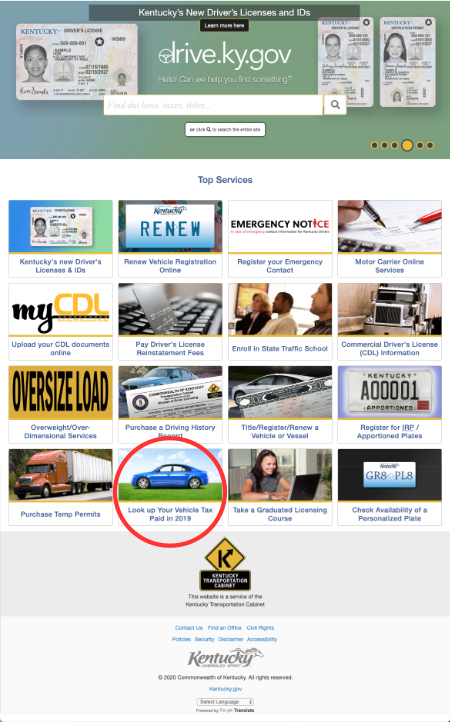

The vehicle sales tax in Kentucky is 6 on all car sales and there are no additional sales taxes by city or county. Relative Content The Kentucky Transportation Cabinet is responsible for all title and watercraft related. B rental of a vehicle.

Maximum Possible Sales Tax. There are no local sales and use taxes in Kentucky. How to Calculate Kentucky Sales Tax on a Car.

Maximum Local Sales Tax. Form TC96-182 properly completed including the owner and vehicle identification sections. A Sold to a Kentucky resident registered for use.

Amount of taxable receipts included on line 22 of the sales tax returns from sales to customers that are residents of the following states. The state of Kentucky has a flat sales tax of 6 on car sales. Average Local State Sales Tax.

Title number OR license plate number. KRS139470 is amended to read as follows. A rental of a shared vehicle by a peer-to-peer car sharing company.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. The retailer must collect Kentuckys 6-percent sales tax on the fee. Are churches exempt from the Motor Vehicle Usage Tax.

Be subject to the sales or use tax. This page describes the taxability of. House Bill 380 Part 36-Sales of Motor Vehicles to Non-ResidentsSection 1.

Unlike sales tax there is no provision in KRS 138470 for exempting church vehicles from the Motor Vehicle Usage Tax. 2 Motor vehicles which are not subject to the motor vehicle usage tax established in KRS 138460 or the U-Drive-It tax established in KRS 138463 shall be. 600 US plus the cost of a notary.

Is the usage tax refundable if an individual titles a salvage vehicle and pays Motor Vehicle Usage. Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price.

Kentucky State Tax Guide Kiplinger

In State Transfers Daviess County Kentucky

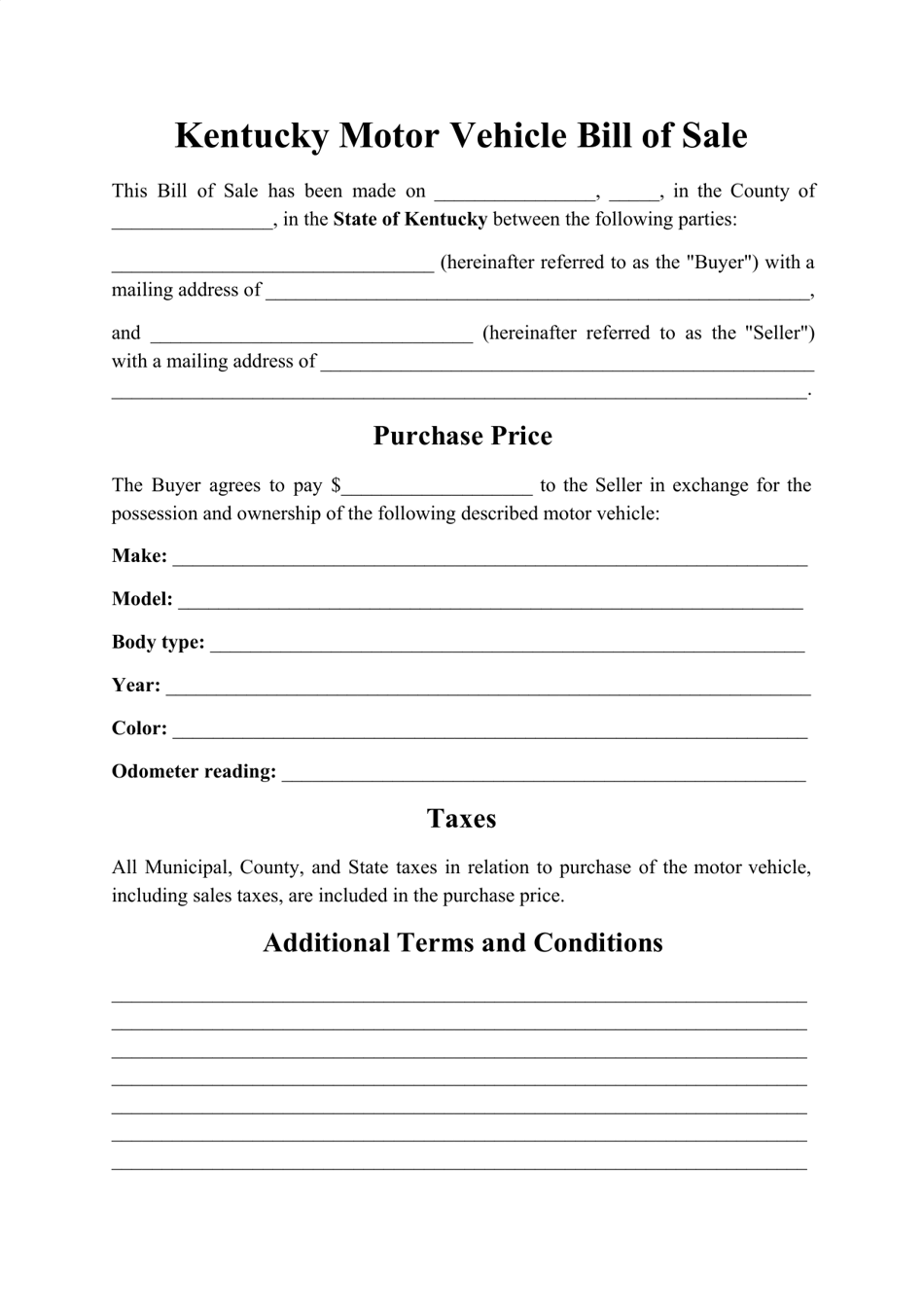

Kentucky Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Carmax Kmx Says Used Car Sales Hit By Waning Consumer Confidence Bloomberg

Why Kentucky S Income Tax Is Going Down Next Year

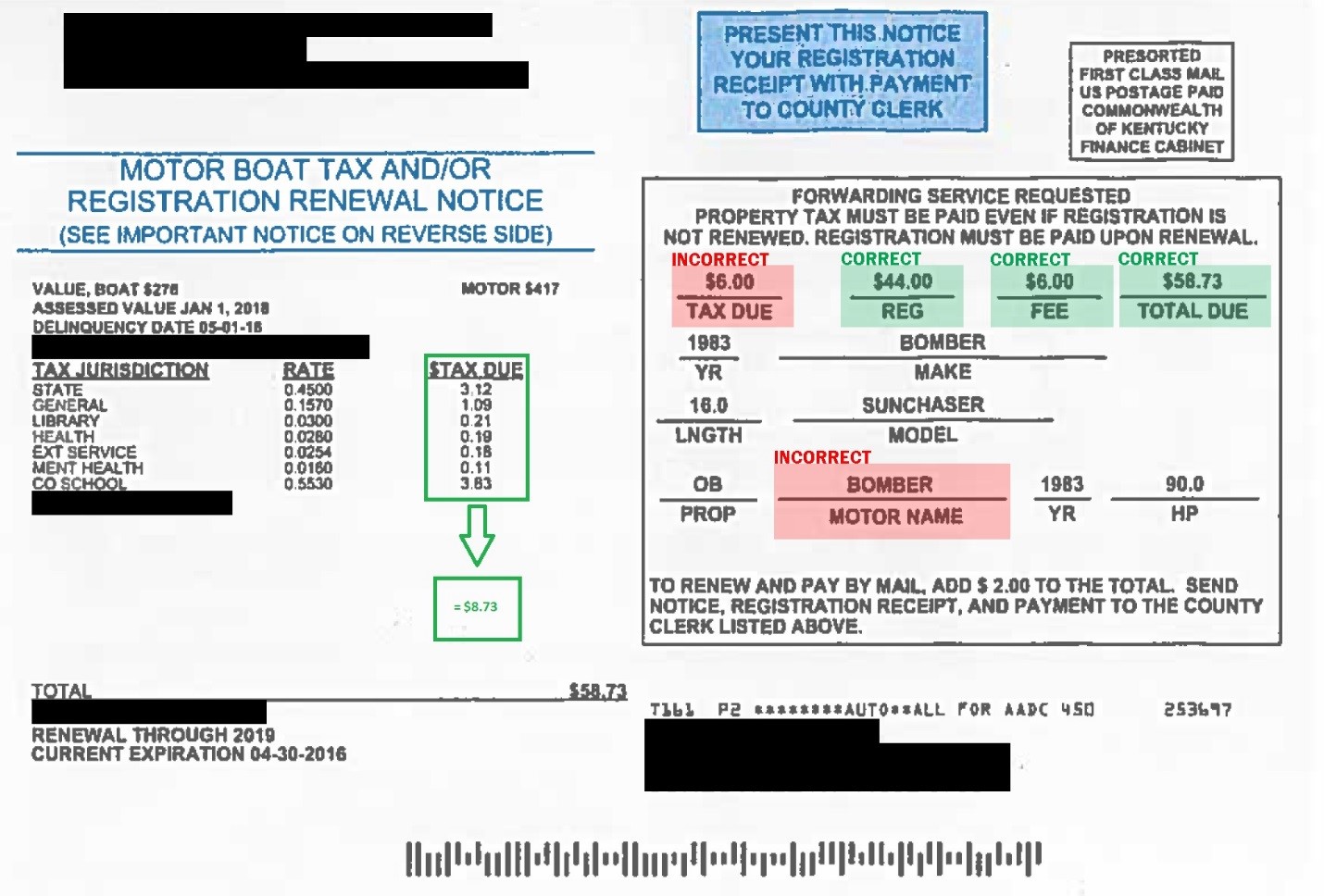

Motor Boat Tax And Registration Renewal Notice Information Department Of Revenue

Nj Car Sales Tax Everything You Need To Know

Vehicle Property Tax Relief And Proposed Temporary Cut In State Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

2022 Kentucky Income Tax Reform Details Analysis

New Car Buyers Could Save With Tax Credit

Gov Beshear Pitches Sales Tax Decrease To Fight Inflation In Kentucky

Kentucky S Car Tax How Fair Is It Whas11 Com

Kentucky S Gas Tax Is Failing To Keep Up With Road Funding Needs

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

New Honda Inventory Honda Dealer In Louisville Ky

Free Kentucky Bill Of Sale Forms 5 Pdf Word Rtf

/cloudfront-us-east-1.images.arcpublishing.com/gray/JUZ2KZZWSJCPROGM5BW5AE4OHE.jpg)

Gov Beshear Provides Vehicle Tax Relief Proposes Temporary Cut In State Sales Tax